Standard Chartered Bank is giving away AirPods Pro that is worth $379 or Sennheiser Momentum True Wireless 2 which is worth S$449!

Just spend S$300 on the newly approved card within 30 days of card approval to qualify for the free gift!

You can opt for S$300 cash instead of the AirPods Pro too.

Note that you need to be a new Standard Chartered Bank (“SCB”) credit card customer.

To get hold of the AirPods Pro, you have to sign up via SingSaver in the links below. You won’t get this if you sign up directly with SCB. This is a SingSaver exclusive deal.

Scroll all the way down for criteria of qualifying spend.

If you are an existing cardholder, your successful application will gain you $30 cash via PayNow.

Promotion Period is from now to 15 June 2021.

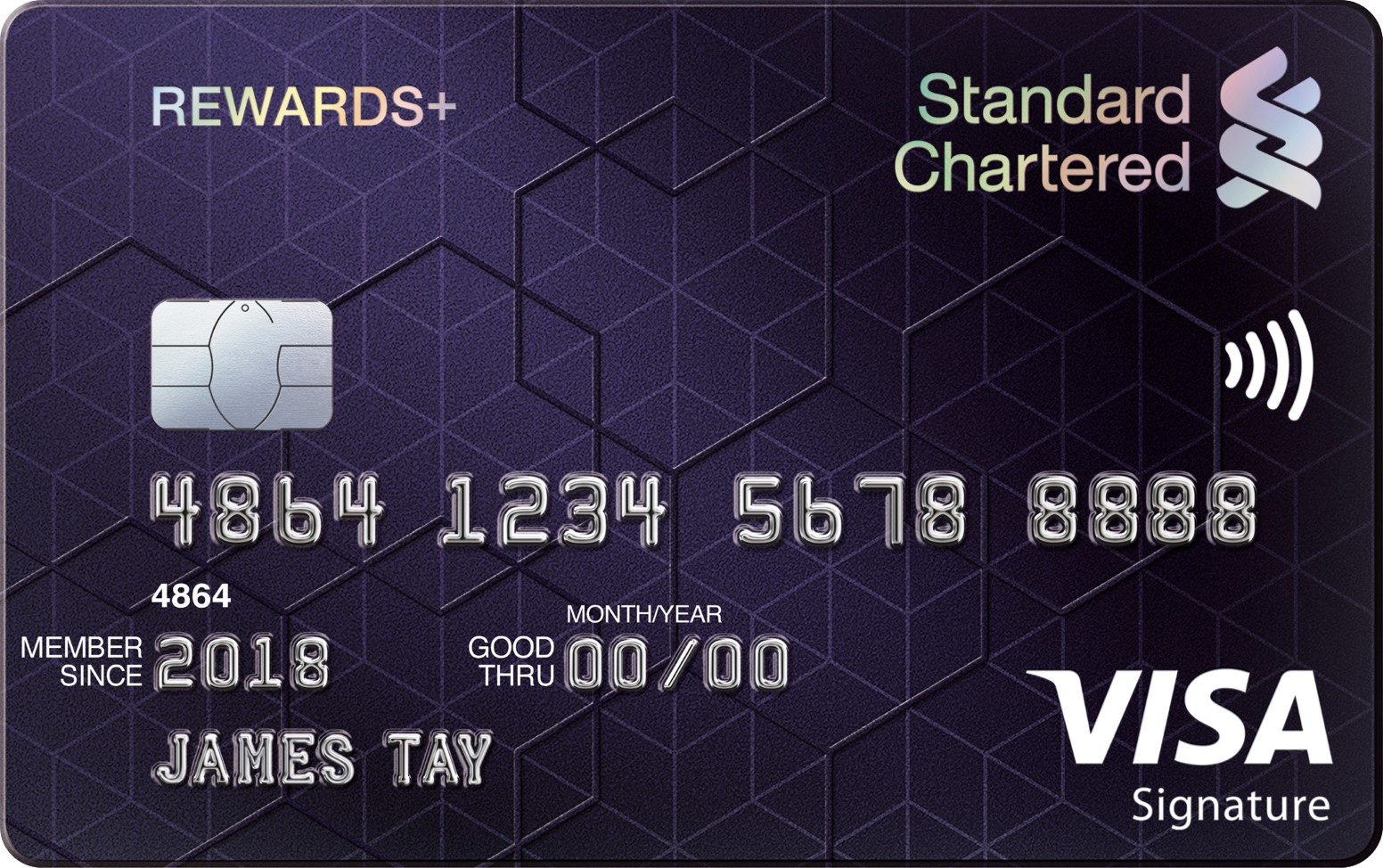

These are the participating credit cards: SCB Unlimited, SCB Rewards+

AirPods Pro – An Upgrade from the earlier generation

If you purchase AirPods Pro on your own, expect to pay an extra $100 more for the improved features as compared to AirPods.

Not only you will get active noise cancellation in AirPods Pro, but the upgraded version also has a noise-isolating design and a longer battery life of 5 hours. The wireless charging function applies too.

And honestly, for such a tiny gadget, it is easy to lose a piece. Getting a free pair seems to make much sense.

If you have both iPhones or MacBook, AirPods Pro will switch seamlessly between both devices.

Sennheiser Momentum True Wireless 2

These Sennheisers are supposed to be among the most refined-sounding wireless earbuds that sound experts have tested.

According to whathifi.com, this Sennheisers second-generation earbuds is lighter, which has reduced the unwanted pressure to part of the ears after a session of listening. The new buds can now last up to six-hour of listening..

Eligible SCB Credit Cards For This Airpods Pro and Sennheiser Promotion

| Participating Credit Card | Key Features | Min. Income Requirement |

SCB Unlimited Sign Up Here | 1.5% cashback for all spend, no min. spend and no cashback cap; Enjoy an accelerated cashback rate of 3% when you deposit funds in your Unlimited$aver account. Cashback capped at $100 per month. | $192.60 (2 year annual fee waiver) |

SCB Rewards+ Sign Up Here | 3.13% cashback on online retail spends in foreign currency Up to 10X reward points for every S$1 spent in foreign currency on overseas retail, dining and travel transactions Up to 5X reward points for every S$1 spent on dining transactions 1 reward point for every S$1 spent on all eligible spend | $192.60 (2 year annual fee waiver) |

Important to Note

A new Standard Chartered Bank credit card customer refers to a new Standard Chartered Bank (Singapore) Limited principal cardholder.

In other words, you must not have any existing or previously cancelled credit cards in the last 12 months.

Remember to Do This After Submitting Your Standard Chartered Bank Card Application To Get Your AirPods Pro or Sennheiser

Record your application reference number. You need this to fill up your Rewards Redemption Form. Each Redemption Form is unique to each individual application.

The Rewards Redemption Form will be sent to your registered email address within the first 14 days of card application.

Please contact info@singsaver.com.sg for assistance if you do not receive your rewards redemption form immediately after application.

Participants who do not complete the Rewards Redemption Form fully, and

accurately will not be eligible for the rewards.

Activate your approved card and make at least one qualifying spend transaction as defined below within 30 days from the approval.

Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from:

(i) any Equal Payment Plan (EPP) purchases,

(ii) refunded/disputed/unauthorised/fraudulent retail purchases,

(iii) Quick Cash and other instalment loans,

(iv) bill payments made using the Eligible Card as a source of funds,

(v) late payment fees and (vii) any other form of service/ miscellaneous fees.

Click here for the detailed Terms and Conditions.

You may also like these posts:

Geniebook Science for Primary School – A Complete Review

6 Best Cashback Credit Cards for Online Grocery Shopping

Admiralty Park Playground – It’s Gigantic!

T-Play Khatib – My Preschoolers Played To Their Hearts’ Content

Receive an Oppo Reno 5Z (worth $529) for new Citibank Cardholders